In 2008, Satoshi Nakamoto published a paper called “Bitcoin: A Peer-to-Peer Electronic Cash System”. This publication triggered a revolution in banking and the financial industries. The dynamics of innovation initiated by the latest developments of blockchain technology and cryptocurrencies will not be without consequences for the cultural sector. Adding a layer of trustless transactions to the internet will result in a fundamental, structural change of how digital and physical media content will be created, discovered, distributed and traded online. It will shake up established structures and business models of centralized platforms and give way to new and unexpected ways of selling and licensing content or addressing a global audience.

We are in the early days of distributed ledger technologies, but it is worth having a closer look at the future of blockchain transactions and the exchange of value on decentralized and distributed networks. Blockchain is here to stay. And it will substantially impact e-commerce, customer relationships and methods of payment, data protection and user account management, content ownership and rights management, the distribution and supply of information, media content or any other kind of digital or physical goods, assets or properties.

This paper will focus on the structural implications of blockchain technology and cryptocurrencies for the creative community in a truly decentralized media environment. It tries to give a brief outlook on the future of business models, services and applications for writers and artists as well as for other professionals within the cultural industries and institutions.

***

“It is the stillest words that bring the storm.

Thoughts that come on pigeons’ feet steer the world”.

(Friedrich Nietzsche, Also sprach Zarathustra)

In 2008, Satoshi Nakamoto published a paper called “Bitcoin: A Peer-to-Peer Electronic Cash System”. In the initial sentence of this relatively short paper Nakamoto comes to the point without further ado: “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution”. No matter how prosaic these words may read, its underlying idea has caused a shift of paradigm in banking as we know it. Bitcoin enables two individuals who do not know each other to exchange money online, directly and immediately; a financial transaction which does not involve any intermediary trusted third party to be valid and binding. Over centuries, our societies have established a relatively stable system of powerful financial institutions, that provide security for the financial and economic sectors and its participants. By offering deposits and loans, defining interest rates, maintaining access to cash and liquidity, controlling the streams of payments or issuing money and governing the value and validation of the currencies private and central banks were the monetary authority. This system has successfully been in place despite well-known downsides of ‘fiat currencies’ — in particular the slowness and high costs of financial transactions, depending as they did on the ability of payment providers, banks and a whole network of financial intermediaries to communicate and settle transactions and exchange its current and valid ledgers. Digital financial transactions via software applications, online services or debit card payments did not structurally change and improve this situation. Bitcoin, however, provided ‘real digital money’ for the first time in history. With cryptocurrencies, rather than a network of centralized institutions, it would be one of distributed and decentralized computer nodes that “timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.” In other words, in its most basic function, the blockchain can be defined as a distributed and decentralized network of nodes. This network maintains a ledger of all online transactions of value exchange. All transactions are being written in blocks of data that are added to the chain. By permanently linking the blocks and distributing the chain of blocks to a large number of independent nodes, a blockchain network creates an immutable record of transactions of the past.

With the concept of ‘proof-of-work’, Nakamoto introduced a fundamental principle of security and trust on the blockchain: effort and reward. The process of creating a new block and adding it to the chain is called mining or validating. Because this process is purposefully time and energy consuming, it ensures that the network converges on a consistent global view of its history, and that no value, e.g. money, would be transferred twice (double spending). It is necessary to mention that there are many different concepts of mining or algorithms to reach a consensus on the legitimacy of a block. With proof-of-work mining, computers in the network are competing with each other by investing computational power in order to solve a cryptographic puzzle. The larger the network and the number of independent miners or validators, the more secure a blockchain will be. The ledger cannot be altered or forked, unless you spend more energy than 50% of the whole network. In open and public blockchains the validation of transactions and the creation of blocks is always incentivized and compensated by receiving a reward or a transaction fee. This monetary incentive and the creation of coins, tokens or assets make the aspect of cryptocurrency an essential part of the security model of the blockchain technology itself.

Decentralization

Bitcoin and other cryptocurrencies have initiated an ongoing process of innovation and disruption of the financial industries. And — in the context of this paper — it is interesting to see how the underlying structural change will have its effect on other areas or industries as well. To fully understand the fundamental and possibly game-changing implications of blockchain technology, it is helpful to have a look at how exactly blockchain makes a difference, and how it differentiates from the internet as we know it.

It is often said that blockchain can be considered as a new ‘layer of trust’, that is being added ‘on top’ of the internet. This is true in many ways. Just like the internet allows for direct and immediate exchange of information and data, the blockchain allows for direct and immediate exchange of value without a centralized and trusted third party or intermediaries. The term ‘value’ can be understood in the broadest sense: money, property, licenses, engagement, reputation, time, labor, etc. Whereas the internet needed centralized and trusted institutions in order to ensure the integrity and legitimacy of transactions and the transfer of value, the blockchain networks will take over this role from now on.

In a period of over 15 years, trade went online and social interactions in the broadest sense have moved into the cloud. Most companies offer services or access to goods through applications on the internet. But the business logic of centralized services on the internet and of supply and demand of e-commerce has led to an accumulation of power and control by a limited number of companies. They accepted and handled payments and debtors management, maintained a platform governance or provided access to services, content and goods or organized logistics and fulfillment.

It seems all too obvious and legitimate that businesses need control; not only to perform their commercial activities, but also for legal reasons. With offering and running applications, connecting people or maintaining financial or other business transactions, come legal responsibilities and obligations. Most businesses need to know their customers and have the power to exclude individuals from their services or refuse to offer to them in the first place. Users, on the other hand, trust known and established brands with their money, data and privacy. In many cases they appreciate their services. In other cases they depend on them, like when getting access to a bank account.

Considering the upsides and downsides of centralized services on the internet, their responsibilities and power reveal a rather delicate and fragile infrastructure. It is no coincidence that blockchain and distributed ledger technologies appear on the business landscape at a time when the flaws of the current centralized set-up are outnumbering its benefits. Evidence for this can be found by looking at the banking sector, e-commerce or social media platforms: trust is a value that does not stick, but has to be earned and sustained in an iterating manner. And this is where blockchain comes into play.

Blockchain has the potential to disrupt the power of centralized institutions, companies and platforms at the same time. As decentralized commerce emerges, new platforms will arise that will work entirely different in a number of ways. Instead of handling and facilitating transactions through their centralized accounts, they will support peer-to-peer transactions with various cryptocurrencies or tokens on different blockchains. Instead of relying on the authority and reputation of known and trusted enterprises and its brands, transactions will be based on ‘trustless trust’, which is established on the blockchain. No third parties will be needed to oversee trade any longer, no banks will be needed for clearing financial transactions or the transfer of value. International sales will be possible without national currency conversions. Transactions will be borderless, permission-less and censorship resistant. And non-the-least, instead of relying on centralized services to guarantee access to content, information or data, users will eventually be in charge of their accounts and become true owners of their assets.

Scarcity

The decentralization of applications and services is one of the driving concepts of the markets and commercial environments that will be established with the emergence of blockchain technology. But there is a second crucial shift that has been caused by blockchain technology: by presenting an entirely new way of dealing with algorithmic validation of peer-to-peer transactions, Bitcoin introduced the concepts of scarcity and value to the digital world!

To give an example: Unlike an e-mail or a file, that will remain as a copy with the sender once it is sent to a third party, an individual Bitcoin that is spent will no longer be available to the individual who spent it. Just like a metal coin, a digital asset can be owned and spent on the blockchain. In the physical world, an item is defined by its integrity; its value by supply and demand. This economic principle basically applies to physical as well as to digital goods. However, the internet and its abundance of data, information and other content has created a problem of value and validation. Where everything can effortlessly be reproduced, value is at stake. For what it was worth, large companies running centralized platforms have tried to address this issue by curating, filtering, bundling or selecting content, and, by doing so, controlling supply and demand of a market they were in charge of. With blockchain and cryptocurrencies their function will change significantly as scarcity will become a feature of the algorithm.

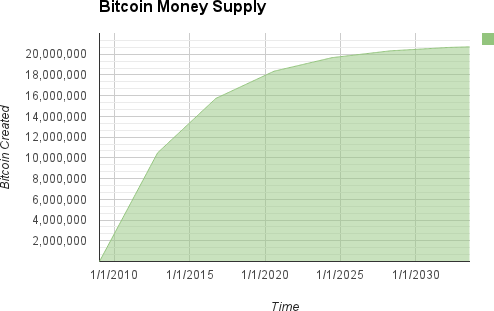

It is the inherent logic of ‘programmable money’, that the number of coins, tokens or assets are limited or defined by design. This is where cryptocurrencies derive their value from; their current and future supply is known beforehand. All monetary assets of open and public blockchains, just like Bitcoin, have a finite and controlled supply and a mathematically defined issuance schedule. Not more than 21 million Bitcoin will be created, and its issuance is determined for more than a hundred years in advance. Approximately in 2140, all 2,099,999 Bitcoin will be mined.

based on a geometrically decreasing issuance rate,

via Antonopoulos.

In 2015 the Ethereum blockchain was launched.

“The Ethereum blockchain not only provided the infrastructure for transacting primitive digital tokens (ether in this case) but also provided the capability for easily creating and autonomously managing other secondary digital tokens of value over the open public Internet without trusted intermediaries. Using this concept of smart contracts, which are effectively applications running atop a decentralized network, tokens can be created and allocated to users, and made to be easily tradable. This process of creating tokens and distributing them to users in return for a network’s primitive digital token (cryptocurrency) is called an ICO process, and can be seen as a novel distribution channel for assets.” (Economics of Initial Coin Offerings)

In other words, smart contracts on the Ethereum blockchain are neither smart, nor are they contracts in the common understanding of the legal term ‘contract’. Instead, smart contracts are deterministic computer programs that execute code according to pre-defined rules, and that enforces the performance of a defined transaction. Moreover, smart contracts allow basically anyone to create their individual token system for the transfer of value on the blockchain or within their decentralized application. This way Ethereum has not only drastically simplified the access to funding capital by allowing companies to offer their issued tokens for sale, but also created new opportunities for innovative business models. Transactions triggered by decentralized applications are settled on the native Ethereum blockchain, making use of the underlying security of the network and its existing infrastructure such as the global network, the broad distribution, the mining infrastructure and its financial incentives.

[In ICO’s (initial coin offerings), tokens are sold in exchange for established cryptocurrencies, fiat money or given away in other ways. It is worth noting that tokens created on the Ethereum blockchain are issued by one smart contract, which is controlled and established by one address (in most cases belonging to one person, group or organization) literally “printing money” of uncertain value when issuing the tokens. In contrast to the native ETH currency, these tokens cannot be mined and also do not contribute to the security of the underlying blockchain itself. Despite the fact that some tokens are being introduced as utility tokens, providing users with future access to a product, service or good, the fact that they are issued by defined (although not necessarily known) organizations, can make them be considered as securities, nonetheless. Financial authorities and regulators around the globe are having a close look at the various ICO’s that are being performed, coming up with different regulatory and legal approaches. At this moment, the field is a grey area for businesses, launching a dApp via ICO, and a highly speculative field for users who are buying into these coins and tokens for other reasons than for their proposed use cases.]

This model to create tokens has been proven to be comparably stable and reliable. Issuance, allocation and transferability are being programmed into an immutable smart contract. On Ethereum, several standards have been established to create individual token systems to store or represent value. Here, I would like to mention two of the standards that allow to create tokenized, decentralized services and applications and have been broadly adopted by the community: the ERC20 and the ERC721 standard.

The ERC20 standard supports the creation of fungible tokens on the Ethereum blockchain. This means that the tokens can be issued in a defined, thus limited number by a smart contract. These tokens are identical and interchangeable, and they can be used as a unit of account, as a store of value or means of exchange of value of the exact same amount.

The ERC721 standard, on the other hand, supports the creation of non-fungible tokens (NFT) on the Ethereum blockchain. These tokens are limited in number, as well. But unlike ECR20 tokens, the ERC721 tokens are unique, distinguishable and serialized. They can only be traded as an entire unit and not be split in value. ERC721 are not interchangeable per se, as two tokens may represent a different value, each. In this way, they are not fungible, but simplify transactions, like the transfer of ownership. Applications that use ERC721 tokens will simply attest ownership of specific physical or digital assets by assigning them to the pseudonymous account numbers of their owners. Apart from the fact that the ERC721 standard provides a deterministic and computational way of processing transactions, by doing so “non-fungible tokens create digital scarcity that can be verified without the need for a centralizing organization to confirm authenticity. […] Blockchain technology is significant because it enables a decentralized way to maintain distinct, digitally scarce items.” (An Overview of Non-fungible Tokens)

Tokenization

ERC20 and ERC721 are examples for technical implementation standards that have been established on the Ethereum blockchain. But tokenization itself is not limited to the Ethereum network. It is a feature of other blockchains as well, that they support the issuance of individual new tokens. Nonetheless, Ethereum has become the most popular platform for start-ups and developers and needs to be given the credit of enabling the rise of new platforms and marketplaces.

The tokenization of assets through fungible and non-fungible tokens can be considered as the stimulus for an entire new economic model based on blockchain technology and cryptocurrencies. Its popularity among the crypto-community is certainly based on the fact that it has become comparably easy to create individual token environments that allow the transfer of value on distributed and decentralized networks. In fact, it has become so convenient and ubiquitous that many experts in the field are predicting a “tokenization of everything”. The idea implies that every form of asset, digital or physical items or good, property or other storage of value could eventually be represented by a token. This is certainly possible from a technical point of view. Tokenization allows to structurally convert digital items or physical goods into digital assets that function just like financial assets of a cryptocurrency: they can be generated, offered and traded on decentralized marketplaces. The token itself is the representation of an item or good, which the token makes exchangeable or tradable on the blockchain. And just like with crypto assets, the value represented by an individual token will be determined by the market. This logic of tokenization can be applied to property rights of tangible, real-world items: a house or a car could be tokenized just like a bottle of wine, which could have been represented by a token long before the harvest has actually been collected and the wine has been bottled. But also rights to intangible goods will — in the long run — most likely be tokenized, like intellectual property rights, patents or licenses to use digital content, digital art, gaming items, or any other digital cultural asset.

Meme’s and Trends

The trend towards tokenization was initiated by a trading platform, serving a ‘very special interest’ of the internet generation: cat pictures. They initiated a shift in paradigm for digital collectibles in particular and e-commerce in general.

“Built on top of the Ethereum blockchain, the first real iteration of a non-fungible standard came about with ERC721. It was popularised in late 2017 with the rapid adoption of CryptoKitties [cryptokitties.co], a game which allowed for the purchase, and subsequent ‘breeding’ of digital cats. These cats were bought and sold as a virtual token, and some have fetched prices over $200,000! At its peak, CryptoKitties was responsible for more than 10% of total transactions on the Ethereum network.“ (What’s the Deal with NFT Standards?).

The company claims that “CryptoKitties accounted for 20–25% of Ethereum’s traffic” and “over 3.2-million transactions have occurred on CryptoKitties’ smart contracts”. Over 1.500 non-fungible tokens have been created since then. CryptoKitties set the standard for other platforms like CryptoPepes (cryptopepes.io), CryptoFlowers (cryptoflowers.io), Cryptocrystal (cryptocrystal.io) and many more variants of the same model. On CryptoCountries (cryptocountries.io) users can buy and collect tokenized images of countries, whereas on Cryptovoxels (cryptovoxels.com) and Decentraland (decentraland.org) users can buy, own and sell ‘land’, representing estate and parcels on a virtual reality platform.

The mentioned platforms implement and transform the principles of blockchain technology — decentralization and scarcity — into a new business model on top of the internet, that differs substantially from the platforms we know so far. ‘Decentralized’ in the context of the new model means that, in principle, it is possible to buy a digital asset independent of the platform that has initially created or promoted the items. To give an example: users are able to purchase CryptoKitties on the cryptokitties.io website, but the same items are also being offered on a platform like Opensea.io. Opensea is the self-proclaimed “world’s largest digital marketplace for crypto collectibles”, where you can “buy, sell, and discover exclusive digital assets” according to the rules of the smart contract and the terms of the respective platform that issued the tokens that represent the collectables.

From cats to digital artwork it is just a small step. 20th century pop culture has blurred the boundaries between what has been considered as trash and prestigious art. So it is not surprising that the art world has embraced blockchain quite a bit. Crypto art can be found on platforms like SuperRare (superrare.co), Cryptopunks (larvalabs.com/cryptopunks) or ‘Creeps & Weirdos’ (dada.nyc/artgallery), a digital gallery for rare digital drawings. Projects like Portion (portion.io), Maecenas (maecenas.co) or KnownOrigin (knownorigin.io) aim to function as “decentralized exchange”, “decentralized gallery” or “decentralized marketplace” for art and collectables. This means that art can be traded transparently, censorship resistant and independent of any specific platform. Furthermore, blockchain is being used to determine the provenance and authenticity of an artwork. Timestamping as a proof of existence, integrity or authenticity can be implemented in various manners: e.g. the Blockchain Art Collective (blockchainartcollective.com) offers RFID chips that can physically be attached to the artworks. The embedded code will allow artists and owners to create digital records on the blockchain that prove authenticity and provenance of a work in the digital record in addition to the paper certificates. And the Codex Protocol (codexprotocol.com) aims to become the leading decentralized title registry of unique art items by writing records of attestations and claims of ownership on the blockchain.

Crypto art has already even become a meme on the internet, and the phenomenon of ‘Rare Pepes’ is just one example for this trend: Rare Pepes are unique illustrations, patchwork and photoshop compositions featuring ‘Pepe the Frog’. Over the last years they have become collectables as if they were trading cards. Early in 2018, one individual card (HOMERPEPE) sold for approximately $38,500 at a Rare Pepe auction in New York. But crypto auctions might as well work a little differently than expected. In December 2018, crypto artist @cryptograffiti auctioned one of his artworks called ‘black swan’ to the lowest bidder, in order to demonstrate the potential of micropayments for the art world. Eventually, the picture was sold for 1 millisatoshi, which was at this time equal to $0.000000037.

1.44 in x 1,75 in (3.55 cm x 4.44.cm), by @cryptografitti

The platform Gods Unchained (godsunchained.com) provides an almost identical reproduction of the experience of collecting trading cards online. It offers rare digital assets, serialized and limited in number. Just like Gods Unchained, Decentraland or Darkwinds (playdarkwinds.com), many other platforms combine the experience of collecting items with elements of gaming. Although the gaming industry has not yet fully embraced blockchain and cryptocurrencies, it is fair to assume that this will only be a matter of time. As a matter of fact, it has already become an integral part of online gaming that users can collect, buy or receive game items, assets or other content as a reward for their engagement. But in most cases, the games’ collectables are limited to be used within the scope of the individual game itself. They cannot be transferred to a different game, let alone be used in a game offered by a competing company. It lies in the commercial interests of software and gaming companies to enforce centralization and closure, which ensures that the users’ money, effort or time will remain stuck in one singular gaming environment. The terms and conditions of Epic Games (the studio behind the biggest online game of all times up to this day) may serve as an example to prove the point that most traditional enterprises have not yet understood, internalized or included the opportunities of blockchain and cryptocurrencies yet. For Fortnite content or currency the company clarifies:

“Neither Game Currency nor Content are redeemable for money or monetary value from Epic or any other person, except as otherwise required by applicable law. Game Currency and Content do not have an equivalent value in real currency and do not act as a substitute for real currency. Neither Epic nor any other person or entity has any obligation to exchange Game Currency or Content for anything of value, including, but not limited to, real currency.”

Fortnite gamers cannot monetize their skins, axes or gliders. These are not redeemable for money, even if they had value that could be represented in “real currency”. They cannot be exchanged across different games or platforms, as they are — in fact — the property of the game, not the owner. But terms will change, and platforms like Gamertoken (https://gamertoken.io) already have created a prototype of a decentralized marketplace for gaming items on the blockchain. Tokenized assets could be transferable from game to game on marketplaces not owned by individual game studios. And users might also appreciate the opportunity to use virtual assets to buy things in real-life, like a coffee or a book, or just offer digital game assets or items for sale in exchange for fiat currencies.

Smart Licensing

A lot has been said about the way digital money will be owned and spend in the age of blockchain. In fact, it seems as if cryptocurrencies mimic the experience of dealing with physical money, such as banknotes and coins, even more closely than expected. Interestingly enough, through tokenization of assets the concept of ownership and property seems to revive again in the digital realm. Just like digital money, physical goods or digital items can be represented as tokens on the blockchain. And the same logic of tokenization can be applied to intellectual property and digital media content.

But wasn’t media consumption all about licensing, rights, access and use instead of ownership and possession? In the age of the internet and its centralized online-media platforms, the concept of ownership has become all too vague. Do readers “own” a digital copy of an e-book they purchased on Amazon? Or do they own a license that permits them to use the subject of a license in a certain way, that is — in this example — defined by Amazon as the operator of the platform and licensor of the content?

If licenses were tokens, they would behave more like property, without losing the benefits of licenses for creators and rights owners. The Content Blockchain Project (content-blockchain.org) — of which the author is a co-initiator — developed a prototype for what the project has called “smart licensing”. The project was initiated in 2016 by a consortium of publishing, law and IT companies, to research the possibilities of using blockchain technologies in advancing the content and media ecosystem. It aims to create technical foundations for a trading environment dedicated to digital media content that facilitates new and innovative ways to offer and purchase content on a decentralized blockchain network. One of the project’s goals has been to simplify the complex process of license management and distribution of digital content by offering a registry of rights and licenses on an open and transparent blockchain ledger. On the Content Blockchain network it will be possible to create and distribute machine as well as human-readable license offerings, called smart licenses. These smart licenses could be represented by license tokens, which would include a specific set of rights to use the content in a specific ways. This model would allow rights owners to offer licenses to retailers (B2B) or users (B2C) alike via tokens on decentralized marketplaces on the blockchain.

The benefits of such a container-model will become more obvious if we look at B2B sales. In order to sell digital content through relevant retailers and shops, rights owners need to negotiate license agreements per individual platform. These negotiations can be time-consuming and complicated for both, rights owners and retailers. Tokenization would, by contrast, allow licensors to publicly offer content licenses in a simple way. Converting license offerings into token offerings would enable shops, retailers and even customers to easily sell or resell the tokens independent of the dominant market players on any possible platform — as they would not sell the license, but only the token with the license included. This model has the potential to simplify any kind of license trade for a great deal. Other projects and startups focus on a similar model of tokenizing media content licenses on the blockchain, like the Crea Project (creaproject.io) and JAAK (jaak.io), who are working on services for record labels and other companies in the music industry. Bernstein (bernstein.io) are aiming at corporate IP, like inventions or designs, that can be registered to obtain blockchain certificates that prove ownership, existence and integrity of any IP asset.

Self-Sovereign Identity

Tokenization has created an entire new way of thinking about cultural assets, value, ownership and transactions on decentralized marketplaces online. Interestingly, on these marketplaces users do not only own their digital assets — they also own their personal accounts and data. In the age of the internet, users were required to register and login to an individual platform in order to use its service. While using a number of services, users provided personal information, ratings, reviews, posts, and other data to many individual companies. This resulted in a growing power of these services and platforms, where access to customer data supported market significance in a reinforcing circle. Despite all efforts to protect the customers’ privacy and data through political regulation, in many cases it has not been fully transparent what the companies actually do with the user data they aggregate.

On decentralized marketplaces users do not necessarily have to register and login to the individual platform in order to use a specific service or to buy or trade items or assets. Users can interact directly with the blockchain or use their blockchain accounts and public keys, to access services on specific platforms. This way, users can provide as much information to a third party as preferred, necessary or requested. To give an example: a service needs to ensure that a user is old enough to perform a legal transaction, yet the user does not need to reveal his/her date of birth in order to provide valid and verified information. A lot of research is currently being done on ‘self-sovereign identity’ (SSI).

List of projects dealing with self-sovereign identity: https://github.com/peacekeeper/blockchain-identity, List of papers, videos, initiatives and other resources: https://github.com/infominer33/awesome-decentralized-id.

Projects like the Sovrin (sovrin.org), Jolocom (jolocom.io), uPort (uPort.me), Blockstack (Blockstack.org) and others are working on creating standards, providing foundational technology, tools and models around SSI. It will certainly take some time for people and businesses to get acquainted with handling their self-sovereign identities. But with a growing number of innovative software and hardware products and wallets, the management of self-sovereign blockchain accounts will get more secure and easier to handle.

D’Apps and Marketplaces

Both trends, the tokenization and self-sovereign identity, will support the emergence of decentralized marketplaces, like OpenBazaar (openbazaar.org) or the ones we have seen for the cultural sector. They have the potential to disrupt the power and influence of the current centralized market behemoths. Decentralized applications on open blockchain networks allow creatives and users to interact directly and securely through accounts they fully control on the platforms they choose. Despite these structural changes of e-commerce in the age of blockchain, intermediaries, shops or and online platforms will not entirely disappear. But their role will be significantly different: customers will be in control of their accounts and assets, and sales, payments and fulfillment will no longer be handled through centralized services. Instead, the new marketplaces will support a broad discoverability of the assets by curating, bundling, filtering, selecting and presenting goods and items. They will allow global, borderless, trustless and censorship resistant transactions; organize a convenient customer experience; support content marketing and introduce new and innovative services and ways for the creative community to offer and users to access the content.

The economy of centralized platforms and marketplaces supported a fundamental shift in the economy of cultural production and distribution on the internet. By adding a layer of trust on top of the internet, blockchain technology certainly has the potential to replace the “old economy” and cause a second fundamental shift of the e-commerce paradigm within a quarter of a century. Blockchain and cryptocurrencies have not only introduced peer-to-peer transactions to the world of banking: financial institutions and insurance companies already feel the pressure on their traditional business models. It is almost certain that blockchain and cryptocurrencies will have a major impact on literally every industry and sector. The logistics and transportation sector is actively investigating this technology and building pilot applications on the blockchain. Legal and governmental services are being discussed and promoted by governments and institutions around the globe. And we have seen a number of examples of blockchain and cryptocurrencies changing the economics of the cultural sectors. What we can observe in visual arts and gaming is certainly a trend towards blockchain and tokenization. This trend will also shape the content industries, like news publishing, trade or academic publishing, the music business, and also the stock photo markets or ticketing services for performing arts or concerts. A lot of projects in the cultural sector have been set up to experiment with models based on the fundamental principles of blockchain and cryptocurrencies: decentralization and scarcity.

Whether most of the mentioned projects will still exist in the year 2020 remains to be seen. The field of blockchain and cryptocurrencies is constantly evolving at a high pace. New and innovative projects are being launched almost every day. On the other hand, we are in the early days of distributed ledger technologies, where expectations are high but use and actual utility is low. Mass adoption of this new technology and its applications is still a far reaching goal. The number of active users of the most popular applications on the various networks is comparably low. However, we might currently be witnessing pigeons’ footprints which will steer the thoughts and the behavior of the generations to come; in Nakamotos’s paper we might have read the quiet words that will bring the storm.

Remarks from the Author

This paper has been written in January 2019 and has been published by the Acción Cultural Española (AC/E) in the AC/E Digital Culture Yearbook 2019 in Spanish language on May 8, 2019. You can download the e-book for free.

Unfortunately, it took a couple of weeks for the paper to be published. I am aware that the market is developing very fast. But when I re-read the post and updated the URL’s, I thought that a lot of what has been written is still up-to-date and valid. Please excuse if I missed an important post or particular platform, and feel free to reach out or comment.

References

List of Mentioned Platforms

The following list is a list of projects mentioned in the paper. They are presented in alphabetical order. The references are for informational purposes only. They must not be understood as a recommendation or financial advice to invest, participate or otherwise engage into the mentioned projects.

Bernstein (bernstein.io)

Blockchain Art Collective (blockchainartcollective.com)

Blockstack (Blockstack.org)

Codex Protocol (codexprotocol.com)

Content Blockchain Project (content-blockchain.org)

Crea Project (creaproject.io)

Creeps & Weirdos (dada.nyc/artgallery)

CryptoCountries (cryptocountries.io)

Cryptocrystal (cryptocrystal.io)

CryptoFlowers (cryptoflowers.io)

CryptoKitties (cryptokitties.co)

CryptoPepes (cryptopepes.io)

Cryptopunks (larvalabs.com/cryptopunks)

Cryptovoxels (cryptovoxels.com)

Darkwinds (playdarkwinds.com)

Decentraland (decentraland.org)

Gamertoken (https://gamertoken.io)

Gods Unchained (godsunchained.com)

Jaak (jaak.io)

Jolocom (jolocom.io)

KnownOrigin (knownorigin.io)

Maecenas (maecenas.co)

OpenBazaar (openbazaar.org)

Opensea Opensea.io

Portion (portion.io)

Sovrin (sovrin.org)

SuperRare (superrare.co)

uPort (uPort.me)

Resources

List of projects, papers, videos, initiatives and other resources, dealing with self-sovereign identity:

https://github.com/peacekeeper/blockchain-identity

https://github.com/infominer33/awesome-decentralized-id

https://www.stateofthedapps.com/rankings

Literature

Andreas M. Antonopoulos, Mastering Ethereum, https://github.com/ethereumbook/ethereumbook

Andreas M. Antonopoulos, Mastering Bitcoin, https://www.oreilly.com/library/view/mastering-bitcoin/9781491902639/

Jason Bailey, What is CryptoArt?, https://www.artnome.com/news/2018/1/14/what-is-cryptoart

Phil Glazer, An Overview of Non-fungible Tokens, https://hackernoon.com/an-overview-of-non-fungible-tokens-5f140c32a70a

Satoshi Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, 2008, https://bitcoin.org/bitcoin.pdf

Sebastian Posth: What is a Smart License, https://medium.com/@posth/what-is-a-smart-license-e71fe3dd2433

Avtar Sehra, Philip Smith, Phil Gomes, Economics of Initial Coin Offerings, http://www.allenovery.com/SiteCollectionDocuments/ICO-Article-Nivaura-20170822-0951%20%20-%20Final%20Draft.pdf

Rhys Skellern, What’s the Deal with NFT Standards? https://medium.com/ecomi/whats-the-deal-with-nft-standards-1383148c48f3